In the dynamic world of trading, success hinges on more than just instinct; it demands rigorous testing and strategic refinement. Enter simulated trading—a powerful tool that allows traders to explore the intricacies of their strategies without the pressure of real financial risk. Imagine the thrill of executing trades in real time, analyzing market movements, and refining your approach, all within a risk-free environment.

This technique is not merely a playground for novices; seasoned traders harness simulation to dissect their methods, scrutinize their decisions, and cultivate a robust trading plan. Whether you’re a fledgling investor or a seasoned market player, understanding how to leverage simulated trading can transform your trading experience, helping you build confidence and skill while navigating the unpredictable waters of the financial markets. In this article, we’ll delve into the steps to effectively implement simulated trading and elevate your strategy to new heights.

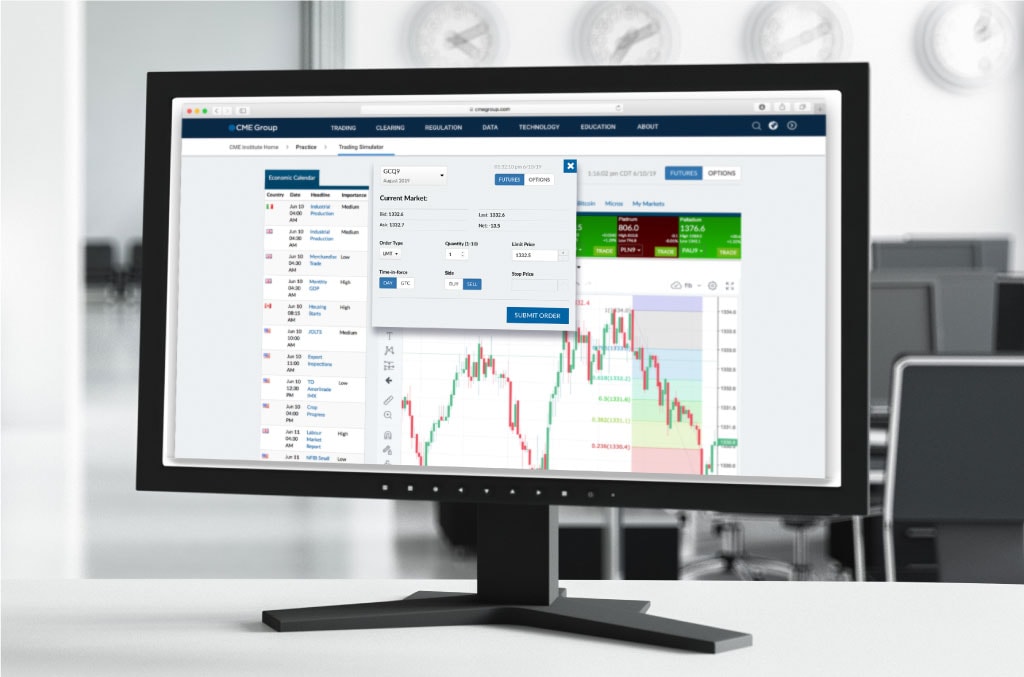

Understanding Trading Simulators

Understanding trading simulators is essential for any trader looking to refine their strategies without the risks associated with real money. These sophisticated tools provide a virtual environment where users can engage in simulated trading, allowing them to experiment with different approaches, analyze market behavior, and track their performance over time.

Imagine being able to execute trades based on real-time data, gauging the results instantly, or utilizing a free bar replay chart to revisit and analyze historical market scenarios—all while remaining completely detached from the financial implications.

This practice not only fosters a deeper comprehension of market dynamics but also builds confidence and skill, enabling traders to transition smoothly into live trading scenarios. As you navigate various interfaces and tools, each click and decision becomes a lesson, shaping your trading acumen in ways that mere observation or study cannot achieve.

Setting Up Your Simulated Trading Environment

Setting up your simulated trading environment is a crucial first step to refining your trading strategy effectively. Begin by selecting a reliable trading platform that offers comprehensive simulation features, allowing you to replicate real-market conditions as closely as possible. Consider customizing your settings—choosing the assets you wish to trade, adjusting risk parameters, and establishing time frames that reflect your actual trading style.

Additionally, dont overlook the importance of incorporating realistic market variables; emulate volatility, news impacts, and even unexpected events. Equip yourself with analytical tools and historical data to forecast potential outcomes, enabling you to observe trends over time. Remember, the goal here is not just to practice but to immerse yourself in a dynamic environment that challenges your decision-making skills and enhances your trading acumen.

Developing Your Trading Strategy

Developing your trading strategy is a dynamic process, one that requires a blend of analytical thinking and intuitive insight. Start by examining market trends, identifying patterns that can influence your decisions, and determining the assets or instruments that resonate with your investment goals. But dont stop there; immerse yourself in historical data and utilize various technical indicators—these tools will offer a clearer picture of potential market movements.

Every trader must also cultivate a personal risk tolerance strategy, framing your approach with well-defined entry and exit points while allowing for the unexpected twists the market might throw your way.

Remember, the most effective strategies are often the result of continuous refinement; embrace the learning curve and adapt as needed, for the market is an ever-evolving entity. Engaging in simulated trading can provide that safe playground where you can test your hypotheses without the stakes, shifting your focus from mere theory to practical application in real-time scenarios.

Conclusion

In conclusion, utilizing simulated trading to test your trading strategy in real-time is an invaluable approach for both novice and seasoned traders alike. By engaging in this practice, traders can gain crucial insights into their strategies, refine their decision-making processes, and build confidence without risking real capital.

Tools such as a free bar replay chart can further enhance this experience by allowing traders to review and replay past market scenarios, providing a deeper understanding of market behavior. Ultimately, embracing simulated trading not only enhances your skills but also prepares you to navigate the complexities of the financial markets with greater agility and knowledge.